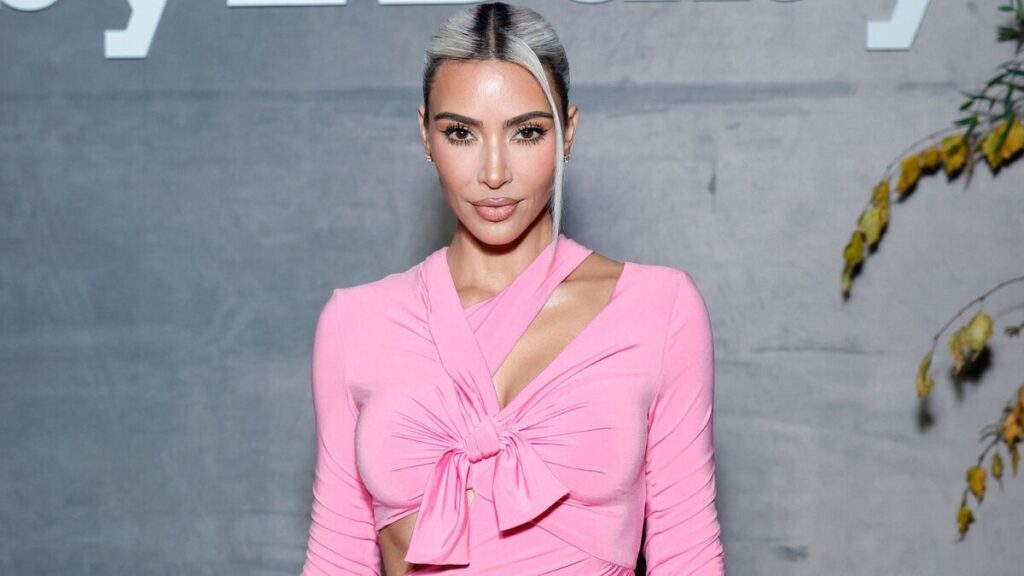

It’s a crisp Tuesday morning in Los Angeles, and Kim Kardashian isn’t striding down a red carpet — she’s leaning over a conference table, dissecting fabric swatches for the next Skims drop. Around her, marketing decks flash on wall screens, supply chain updates buzz across Slack channels, and the hum in the room feels more Silicon Valley than Sunset Boulevard.

For years, the world knew Kim as the face of tabloid culture, a fixture on reality TV whose fame seemed inseparable from family drama. But that narrative misses the real headline: she has methodically transformed her image into a $1.7 billion empire built on innovation, timing, and relentless brand discipline. Today, Kim is more than a celebrity; she’s a modern celebrity CEO, steering a shapewear brand valued in the billions, securing streaming deals, and leveraging a personal brand that outpaces many Fortune 500 marketing departments.

Her net worth — estimated at well over a billion dollars — isn’t just the product of viral moments; it’s the return on a decade-long experiment in turning attention into equity. This is the story of how Kim Kardashian turned notoriety into strategy, and strategy into one of the most profitable personal brands in the world.

From Tabloid Headliner to Billion-Dollar Brand Architect

When Kim Kardashian first appeared in the public eye, it was as Paris Hilton’s stylish shadow — the friend who occasionally stole a flashbulb’s attention on the red carpet. By 2007, she was no longer a background figure; she was the center of Keeping Up with the Kardashians, a reality show that critics dismissed but audiences devoured. For many, this was the height of “famous for being famous” culture.

But while headlines obsessed over the spectacle, Kim was quietly shaping a different narrative. This wasn’t a stumble into fame — it was a strategic reinvention. She studied the mechanics of attention, understanding that consistent visibility could be leveraged into cultural influence. Every public appearance, brand deal, and storyline became part of a long game: converting audience fascination into lasting commercial power.

Key cultural moments — a Vogue cover, a high-profile marriage, her pivot into beauty and fragrance — weren’t just gossip fodder; they were chapters in a deliberate brand evolution. By the time Skims launched in 2019, the public perception of Kim had shifted from reality star to billion-dollar brand architect, a woman who had mastered the art of shaping public narrative and monetizing it across industries.

Her rise wasn’t an accident; it was the result of calculated moves over more than a decade, each designed to transform curiosity into credibility. The arc from tabloid headliner to respected entrepreneur is more than personal reinvention — it’s a case study in turning cultural capital into enduring business success.

The Skims Phenomenon — How Shapewear Became a Global Fashion Disruptor

The Founding Vision and Market Gap

When Skims debuted in 2019, it didn’t arrive as “just another celebrity-backed fashion brand.” It entered a shapewear market dominated by legacy players like Spanx — but with one major difference: it didn’t treat fit and inclusivity as afterthoughts.

Kim Kardashian had long been candid about the lengths she went to achieve a seamless look under clothes, from cutting and sewing existing shapewear to layering pieces for a custom fit. That personal frustration mirrored what millions of women experienced: products that smoothed but didn’t truly fit. Many lacked shade diversity for different skin tones, and sizing often excluded those outside a narrow range.

Skims answered with inclusive sizing (XXS to 5X) and an expansive palette of “nude” shades designed to match multiple skin tones. The brand positioned itself in the sweet spot between function and fashion — shapewear that could be worn as outerwear, marketed as luxury basics rather than hidden undergarments.

Kim’s own body-positive visibility and global platform gave Skims instant credibility. But it was the product’s attention to real-world fit and style that built loyalty. In a market where competitors felt functional but uninspired, Skims redefined shapewear as a form of self-expression, not compromise — and that’s why it became a phenomenon.

D2C Domination and Viral Marketing Playbook

Picture the Skims team gathered around a sleek glass conference table, mood boards lining the walls, a massive screen pulsing with Instagram engagement metrics. The conversation isn’t about slow seasonal releases — it’s about the next drop. In the direct-to-consumer model, urgency is currency, and Skims has mastered it.

Every launch is teased through a carefully crafted stream of Instagram storytelling: behind-the-scenes shots of fittings, Kim herself modeling the new collection, and bite-sized videos showing how each piece moves in real life. Influencers, from TikTok creators to A-list friends, receive curated PR boxes timed to flood feeds within hours of each release.

But the real magic lies in Skims’ ability to tap into cultural moments. A Valentine’s Day capsule photographed in heart-shaped candy boxes, a collaboration tied to the Olympics, even subtle nods to viral pop culture memes — each campaign feels less like an ad and more like a social media event.

While Spanx leans on functional heritage and Savage X Fenty sells a message of bold empowerment, Skims sits in the space where utility meets pop culture hype. A side-by-side comparison table makes that positioning clear — and reveals just how intentionally this virality is engineered.

Beyond the Boardroom — Reality TV as the Engine of Influence

Monetizing the Spotlight

For Kim Kardashian, Keeping Up with the Kardashians was never just a peek into family life — it was a 20-season masterclass in audience cultivation. Each episode doubled as a low-key marketing channel, with strategic product placement woven into storylines: a fragrance launch mentioned over breakfast, a Dash store opening framed as a family milestone, a beauty product casually used in a makeup scene.

By inviting viewers into her daily routines, Kim built an intimacy that traditional advertising could never buy. That trust through familiarity made fans more likely to try what she wore, used, or endorsed.

Financially, KUWTK delivered millions in salary and syndication deals, but its greater value was brand equity. It transformed her from a name in gossip columns into a relatable figure with a loyal global audience — a ready-made customer base that would later fuel Skims, beauty lines, and every new venture she launched.

The Pivot to Hulu and Streaming Strategy

When the Kardashians announced their move from E! to Hulu in 2021, it wasn’t just a network change — it was a content platform shift designed for a new era of media consumption. Hulu’s on-demand model gave the family direct access to a younger, global streaming audience that had largely abandoned cable.

The format itself evolved: sleeker production, more behind-the-scenes business moments, and a pace that mirrored the immediacy of social media. This allowed for tighter brand integration — Skims drops, beauty launches, and partnerships could be filmed, edited, and released closer to real time, turning each episode into a more effective marketing tool.

In the broader context of digital entertainment branding, the Hulu deal positioned Kim not just as a reality TV star but as a content entrepreneur, leveraging the streaming economy to keep her brand top-of-mind in a world where attention is the most valuable currency.

Diversified Hustle — From Fragrance to Mobile Apps

Kim Kardashian’s empire isn’t built on a single product — it’s a carefully layered business portfolio that’s as diverse as it is strategic. Beyond Skims, she’s dabbled (and often succeeded) in beauty, fragrance, tech, and even gaming, each venture reflecting a keen sense of timing and brand fit.

Take KKW Beauty. Launched in 2017, it quickly became a staple in the celebrity beauty boom, riding the wave of contouring culture that Kim herself popularized. But by 2021, she shut it down, citing a rebrand and product reformulation. This wasn’t failure — it was a calculated move in the product lifecycle, allowing her to reposition in a saturated market and modernize branding for long-term relevance.

Case Study Box — KKW Beauty’s Rebrand:

- Lesson 1: Don’t be afraid to pause a profitable venture to future-proof it.

- Lesson 2: Consumer trust grows when rebrands come with transparency and clear improvement.

Then there’s fragrance. The KKW Fragrance line tapped into celebrity licensing appeal, selling millions of bottles, but faced stiff competition from influencer-led brands and shifting consumer trends toward niche, artisanal scents.

Her surprise hit? Kim Kardashian: Hollywood, a mobile game that blurred digital branding and entertainment, generated over $200 million in revenue. It proved she could monetize her persona in non-traditional formats — and that fans would engage beyond fashion and beauty.

For entrepreneurs, Kim’s track record underscores this: diversify with intention, time your moves with cultural currents, and know when to reinvent before the market forces you to.

Net Worth in Context — How Kim Compares to Her Peers

Kim Kardashian’s net worth is estimated at around $1.7 billion, according to Forbes, placing her firmly in the upper tier of celebrity billionaire rankings. Still, the real story emerges when you compare her portfolio to other entertainment and fashion powerhouses.

| Celebrity | Estimated Net Worth | Primary Revenue Sources | Brand Model |

| Kim Kardashian | ~$1.7B | Skims, reality TV, licensing, endorsements | Recurring product demand, D2C fashion |

| Kylie Jenner | ~$750M–$900M | Kylie Cosmetics, endorsements | Seasonal product drops, beauty licensing |

| Rihanna | ~$1.4B | Fenty Beauty, Savage X Fenty, music | Hybrid beauty/fashion, luxury partnerships |

| Beyoncé | ~$540M–$600M | Music, Ivy Park, endorsements | Seasonal capsule releases, touring |

The difference? Skims’ valuation model is rooted in repeat-purchase products — shapewear and loungewear that customers buy in multiples, across seasons, and in evolving styles. Unlike seasonal drops in music or luxury apparel, Skims generates steady, predictable revenue streams, more akin to consumer staples than one-off fashion hype.

This contrasts sharply with Kylie Jenner’s beauty empire, which relies heavily on launch-day sales spikes, or Rihanna’s Savage X Fenty, which blends lingerie with the flash of fashion shows but faces slower re-purchase cycles. Beyoncé’s Ivy Park, while culturally impactful, operates on limited-edition collaborations that spike interest but don’t sustain continuous sales volume.

In the Kim Kardashian vs. Kylie Jenner net worth debate, Kim’s advantage comes from building a brand with both scale and longevity. Her ability to position Skims as both a cultural statement and a functional wardrobe essential has given her a rare business edge — one that could keep her at the top of celebrity wealth rankings for years to come.

The Legal Mindset — How Studying Law Shapes Her Brand

In 2019, Kim Kardashian shocked skeptics by announcing she was studying to become a lawyer — a move that seemed worlds apart from her usual headlines. But this wasn’t a publicity stunt. Her involvement in justice reform cases, including helping secure the release of incarcerated individuals, revealed a side of Kim rooted in persistence, research, and real-world impact.

For a celebrity whose brand was once built on glamour and entertainment, this pivot added unexpected depth. It positioned her as a figure of celebrity activism, willing to leverage her platform for systemic change. The result? A measurable boost in brand trust. Fans who once followed her for style tips began to see her as a multi-dimensional public figure with convictions beyond commerce.

By weaving her legal journey into interviews, social media updates, and even Hulu episodes, Kim has created a rare blend of relatability and authority — proving that advocacy can strengthen a personal brand while also driving meaningful change.

A Day Inside the Kim Kardashian Machine

The first thing I notice when I step into the Skims headquarters is the hum — a mix of soft chatter, tapping keyboards, and the muted thud of fabric rolls being stacked in the corner. Kim is already there, leaning over a long table covered in swatches of buttery-soft jersey and sculpting knit, running her fingers across each one with the same precision you’d expect from a couture designer.

We move from the design room to a glass-walled conference space where her team is reviewing social media analytics in real time. On the big screen, I see engagement spikes from a teaser video posted just an hour ago. Kim listens, asks pointed questions about conversion rates, then pivots to discuss packaging tweaks for the next drop.

Later, we step into the warehouse — neat rows of beige, black, and blush-toned boxes ready to ship worldwide. She stops to chat with a staffer about inventory flow, making notes on her phone. There’s no entourage fanfare here, just a CEO making sure operations run tight.

By midday, we’re back in her office for a media call. She shifts effortlessly from talking about justice reform efforts to describing the technical stretch in a new lounge set. It’s a masterclass in multitasking — one minute she’s the advocate, the next, the marketer, always the strategist.

Walking out at day’s end, I realize the billion-dollar valuation isn’t just about shapewear or celebrity. It’s built on this relentless, detail-driven energy — the kind you can feel humming through every corner of her empire.

Controversy, Criticism, and the Calculus of Public Perception

For Kim Kardashian, controversy has never been a career-ending threat — it’s often been a brand stress test. From accusations of cultural appropriation in fashion campaigns to backlash over heavily retouched photos, each incident has carried a level of reputation risk that could derail a less media-savvy figure.

Her approach to crisis PR is rarely reactive panic. Instead, Kim tends to acknowledge criticism selectively, adjusting course when necessary while keeping the larger brand narrative intact. When Skims faced scrutiny over its original name (“Kimono”), she swiftly rebranded, framing the decision as a gesture of cultural respect. The move didn’t just neutralize outrage — it generated a wave of positive press that introduced the brand to new audiences.

Other times, silence is the strategy. By avoiding overexposure to a controversy, she allows news cycles to pass, preventing further amplification. This balance between engagement and restraint is part of her narrative recovery toolkit.

In some cases, she’s even flipped criticism into momentum. Social media debates about her body shape or style choices often drive more attention to the products she wears or endorses. The result is a paradox: moments of public backlash can spark sales spikes, proving her ability to turn cultural friction into commercial advantage.

The answer to “How does she handle criticism?” is simple — with calculation, patience, and an instinct for timing that keeps her brand resilient in the face of scrutiny.

What’s Next — AI, NFTs, and the Future of the Kardashian Brand

If Kim Kardashian’s career has proven anything, it’s that she’s rarely late to a cultural or commercial shift — and often ahead of it. Looking forward, her empire could expand into virtual fashion and the metaverse, where digital wardrobes and avatar styling are fast becoming status symbols. Skims could easily launch limited-edition “meta-shapewear” for online identities, blending real-world influence with virtual prestige.

In the realm of AI-driven personal shopping, Kim’s deep understanding of body diversity and fit could power algorithms that recommend products with unprecedented accuracy — merging her brand’s inclusivity ethos with cutting-edge tech.

And with Web3 branding gaining traction, NFTs tied to exclusive collections, behind-the-scenes content, or VIP access could strengthen customer loyalty while creating new revenue streams. Her history with direct-to-consumer innovation suggests she’d approach these ventures with the same blend of pop culture savvy and operational rigor that made Skims a success.

For Kim, the next frontier isn’t just fashion or media — it’s owning the intersection of celebrity, technology, and commerce before anyone else can.

The Business of Being Kim

Kim Kardashian’s rise from reality TV star to billion-dollar entrepreneur is more than a tale of ambition — it’s a blueprint for 21st-century personal brand strategy. She’s shown that sustained cultural influence isn’t about chasing every trend, but about building systems that turn attention into equity. Skims, her legal advocacy, her media pivots — each move reflects a calculated layering of identity, product, and platform.

Her career raises a sharper question: in an era where influence can be monetized instantly, has Kim redefined the very architecture of fame? She’s blurred the boundaries between celebrity and CEO, reality show and brand incubator, fan engagement and customer acquisition.

The business of being Kim isn’t just a personal success story — it’s a case study in how cultural capital, when managed with precision, can compound into a global empire.

Mohit Wagh is the co-founder of The Graval with over 10 years of experience in SEO and content strategy. He specializes in crafting data-driven, authoritative content that blends cultural insight with digital growth.

6 thoughts on “Inside Kim Kardashian’s $1.7 Billion Empire: Skims, Reality TV, and the Business of Being Kim”