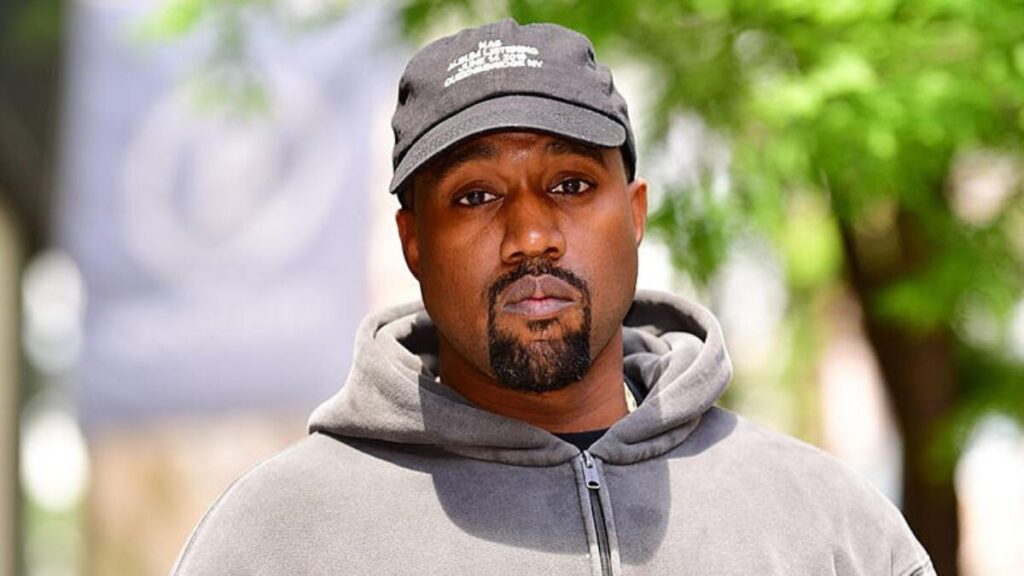

Kanye West has long been a magnet for headlines — not just for music or fashion, but for meltdowns, reinventions, and erratic brilliance that defy easy categorization. But beyond the controversy and spectacle lies a deeper, more elusive story: a celebrity asset empire built in shadows, stitched together through hidden real estate holdings, layered LLCs, and post-Yeezy ventures few truly understand. In 2025, Kanye West’s wealth is less about what’s flaunted and more about what’s concealed.

Is he still a billionaire? Who controls the remnants of Yeezy after Adidas, and what’s the real value of his sprawling ranches, his music IP, or the cryptic entities under the Donda brand umbrella? As traditional wealth estimators like Forbes wrestle with fluctuating data, the truth is more complex — and far more interesting.

To understand Kanye West’s net worth in 2025, we must go beyond spreadsheets and social media. This is a financial puzzle where ego, art, and enterprise collide — and what emerges isn’t just a dollar figure, but a new model for wealth in the fame economy.

What happens when an artist becomes an empire — and the empire begins to fragment? Let’s start with the ground he owns.

The Silent Kingdom — Kanye’s Real Estate Holdings Beyond the Headlines

From Wyoming to Malibu: Unraveling the Mystery of His Property Footprint

Kanye West’s real estate portfolio reads like a coded blueprint of his identity — sprawling, strategic, and deliberately cryptic. There are the Wyoming ranches, bought at the height of his “Yeezy as a sovereign state” era, echoing frontier independence and creative isolation. Then there’s the Malibu house, a stark concrete shell designed by Tadao Ando — minimalist, brutalist, and uninhabitable by most standards, yet a bold architectural statement.

His former Hidden Hills estate, once shared with Kim Kardashian, represents the peak of domestic opulence — now part of a divided empire. Many of his properties are tucked behind LLCs and trusts, making true ownership hard to confirm. Some acquisitions have vanished from public records entirely, while others are whispered about in legal filings and real estate forums.

Is this a strategy to shield assets, protect privacy, or sculpt myth? Probably all three. In Kanye’s world, real estate isn’t just wealth — it’s a projection of power, persona, and paranoia.

Why Kanye Buys, Not Just Lives: Real Estate as a Statement of Power

For Kanye West, buying property isn’t just about where he sleeps — it’s about what he says without words. His obsession with minimalist and brutalist architecture reveals more than a design preference; it’s a declaration of intent. In a 2020 interview, he famously said, “I’m not building a house, I’m building a concept.” His homes are less about comfort and more about control — stripped of excess, stripped of distraction.

Take the Malibu concrete fortress, designed by Tadao Ando: windowless, raw, almost bunker-like. It feels less like a beach house and more like a statement of isolation, focus, and strength. The Wyoming ranches? Vast, remote, and self-sufficient, reflecting a desire to operate beyond the reach of corporate America or mainstream media.

In Kanye’s world, real estate is a form of authorship. Each property is a canvas, a boundary, a declaration of selfhood. He’s not buying homes — he’s building domains.

Beyond Yeezy — The Business Web No One’s Fully Mapped

The Tangled Network: Entities, Shell Companies & Silent Partners

Peeling back the layers of Kanye West’s business ventures feels less like a simple audit and more like stepping into a hall of mirrors. His empire isn’t centralized under one corporate banner — it’s dispersed through a maze of LLCs, shell companies, and silent partnerships, many of them cloaked in obscure names or filed in opaque jurisdictions.

Take Donda Holdings, a hub that has reportedly housed everything from fashion trademarks to industrial design concepts. Then there are entities tied to his music publishing rights, some of which are rumored to operate under aliases or secondary trusts. Add speculative private equity investments in entertainment and tech startups — including flirtations with blockchain platforms and social media alternatives — and the web becomes even harder to trace.

This complexity isn’t accidental. It may serve strategic purposes: tax efficiency, IP protection, or simple control. But it also raises questions about transparency — and what happens when controversy disrupts that web. In Kanye’s world, the corporate structure is part of the art, and understanding it means seeing not just what he builds, but how he hides it.

Fashion Aftermath: What Remains After Adidas and Gap?

The collapse of Kanye’s deals with Adidas and Gap wasn’t just a financial rupture — it was a seismic shift in how celebrity fashion empires are perceived and valued. At its peak, the Adidas Kanye deal reportedly made Yeezy worth upwards of $1.5 billion. But once partnerships crumbled over incendiary comments and erratic behavior, the valuation became a moving target — one that’s now defined by intellectual property, not mass production.

Kanye retained ownership of the Yeezy trademarks — a critical foothold in the fashion world. But without the manufacturing, distribution, and retail muscle of Adidas or Gap, the brand’s scalability and market relevance have plummeted. What’s left is a fashion brand IP asset that is powerful but idle, like an abandoned factory with its name still glowing.

The big question is: Can Yeezy exist without mainstream infrastructure? Or does it become a case study in celebrity brand collapse — a once-unstoppable label now caught in legal wrangling and brand purgatory? For now, Yeezy’s valuation lives in limbo, tethered more to Kanye’s next move than any balance sheet.

“I Was There” — The Day Yeezy Cracked

I still remember the silence before the chaos.

It was supposed to be a standard call — a routine brand alignment meeting between Yeezy’s team and Adidas execs. I was there as a third-party brand consultant, brought in to help with narrative cohesion ahead of the new drop. But what unfolded that day wasn’t business. It was an implosion.

Kanye had joined late, camera off. When he finally unmuted, his voice was calm — eerily so. Then came the tirade: complaints about design theft, disrespect, and vision being diluted. He didn’t raise his voice, but the words landed like grenades. No one pushed back. You could hear the Adidas side recalibrating in real-time — corporate composure clashing with creative volatility.

What rattled me most wasn’t the anger. It was how deliberate it felt. Like he knew the bridge was going to burn, and he brought gasoline.

In hindsight, that call wasn’t a breakdown. It was a pivot. The moment Kanye turned Yeezy from a billion-dollar brand into a personal rebellion. The spreadsheet people saw a collapse. But to him, I think it was clarity — a reset, not a retreat.

That day, I stopped thinking of Yeezy as just a label. I saw it for what it was: a manifesto in disguise.

Kanye vs. The Billionaire Boys’ Club: A Comparative Lens

Kanye, Jay-Z, and the Hip-Hop Capitalist Archetype

In the world of hip-hop billionaires, Jay-Z vs. Kanye represents a study in contrasts — not just in personality, but in celebrity investment strategies. Jay-Z plays the long game: strategic equity in brands like Armand de Brignac, Uber, and Tidal, with a quiet emphasis on ownership, diversification, and generational wealth. His portfolio is structured, predictable, and tailored for legacy.

Kanye, on the other hand, built fast, loud, and with fire. His empire exploded through Yeezy — a brand born of disruption, not structure. Where Jay makes deals in backrooms, Kanye builds empires in the open, often through chaos. He took risks most moguls wouldn’t — betting on fashion as his vehicle, then torching partnerships in pursuit of control.

Both reached billionaire status, but through wildly different blueprints. If Jay-Z is the architect of stability, Kanye is the architect of volatility — a financial archetype driven more by vision than valuation. And that’s what makes his rise — and fall — uniquely Kanye.

Enter Elon & Ye: Celebrity vs. Eccentric Wealth

Put Kanye West and Elon Musk side by side, and the comparison almost writes itself: two volatile visionaries, obsessed with control, allergic to filters, and dangerously fluent in spectacle. Both have weaponized unpredictability — Kanye with chaotic fashion drops and public fallouts, Elon with meme-stock manipulation and impulsive platform takeovers.

But their approaches to eccentric wealth diverge in key ways. Elon, for all his Twitter theatrics, maintains a spine of structure — SEC filings, board seats, scalable products. Kanye, in contrast, often builds without a business model — driven by instinct, abstraction, and a refusal to play by the usual rules.

The irony? Both attract cult followings, even when their decisions wreak havoc on valuations. One sells electric futures; the other, emotional disruption. It’s genius and recklessness on the same spectrum — but while Elon cloaks his chaos in spreadsheets, Kanye lets his bleed across headlines.

In the fame economy, predictability is boring. Kanye and Elon bet on the opposite — and built empires out of the unexpected.

The Post-Yeezy Puzzle: What’s Kanye Worth in 2025?

Why Net Worth Estimates Are Flawed (Especially for Kanye)

Net worth sounds like a hard number — until you try to calculate it for someone like Kanye West. Most media outlets rely on a blend of public filings, brand valuations, and estimated earnings to create flashy figures. But celebrity net worth accuracy is often more art than science, and in Kanye West’s case, it’s nearly impossible to pin down.

His assets aren’t fully liquid or public. His real estate is often held through trusts, obscuring ownership. His companies, like Donda and Yeezy, are privately owned with no transparent revenue reporting. Worse still, private asset valuation — especially around intellectual property like trademarks and music catalogs — swings wildly depending on market sentiment or pending lawsuits.

After the Adidas fallout, some reports slashed Kanye West’s net worth in 2025 by billions, while others argued he still held massive value in IP and cultural capital. The truth lies somewhere between spreadsheets and speculation.

In short, Kanye’s wealth isn’t just about what’s seen — it’s what’s hidden, devalued, or misunderstood in traditional models. And that makes the math very messy.

Speculative Assets, Spiritual Capital & Non-Financial Wealth

If Kanye West’s financial blueprint seems confusing, it’s because part of his wealth isn’t measurable — at least not in dollars. In the wake of Yeezy’s collapse and brand fallout, Kanye appears to be investing in something harder to quantify: intangible assets like cultural resonance, ideological influence, and spiritual identity.

He’s launched faith-based ventures, including plans for Christian schools and gospel-driven creative platforms. These aren’t traditional revenue streams, but they speak to his evolving definition of value — one that leans more on spiritual capital than stock options. Even his public persona, flawed and polarizing as it is, functions as currency in the celebrity influence economy. He can ignite global conversation with a single statement — and that power, though unstable, is undeniably valuable.

Is this sustainable? That depends on whether Kanye’s audience still sees him as visionary or a relic. But if cultural relevance is the new currency, Kanye may still be wealthier than the numbers suggest.

A Legacy Rewritten — Will Kanye Be Remembered as an Artist or a Tycoon?

Kanye West’s legacy has never fit into a single box. He isn’t just a producer, rapper, designer, or entrepreneur — he’s all of them, layered over a personality that both fuels and fractures everything he touches. The question isn’t whether he made an impact — it’s which version of Kanye will history remember.

Will it be the visionary artist who reshaped hip-hop with The College Dropout and My Beautiful Dark Twisted Fantasy? The fashion disruptor who turned Yeezy into a billion-dollar cultural monolith? Or the erratic mogul whose public outbursts unraveled partnerships and trust?

Some will say he transcended the mold of celebrity entrepreneurship. Others will argue he built an empire on ego — and then burned it for control. The truth may lie in the tension between the two.

Long after the balance sheets fade, what remains is a body of work that defied convention — musically, visually, financially. Whether viewed as genius or self-sabotage, Kanye’s arc reflects the volatility of fame, the cost of conviction, and the risk of betting everything on your name.

Decoding the Puzzle — What Kanye Teaches Us About Wealth in the Fame Economy

Kanye West’s financial story isn’t just about numbers — it’s a mirror held up to the modern fame economy. His rise and unraveling reveal how wealth today is built not only on assets, but on attention, identity, and myth. In an age where celebrity brands often outpace traditional businesses, Kanye became the prototype and the warning sign.

He turned cultural relevance into currency, blurred the lines between product and persona, and showed how fast value can evaporate when the story shifts. His ventures — from Yeezy to Wyoming — weren’t just investments, they were expressions of control, art, and belief. But that same belief sometimes blinded him to risk, partnerships, and public trust.

More than a mogul or musician, Kanye represents a new class of wealth: volatile, narrative-driven, and emotionally charged. He’s a case study in how influence can inflate or destroy value, and how legacy is shaped as much by missteps as by milestones.

In decoding Kanye’s empire, we don’t just understand him — we understand the economy that made him possible.

Nishant Wagh is the founder of The Graval and a seasoned SEO and content strategist with over 15 years of experience. He writes with a focus on digital influence, authority, and long-term search visibility.

4 thoughts on “Kanye West’s Asset Empire: Hidden Real Estate, Business Ventures, and the Post-Yeezy Financial Puzzle”